Finding the Ideal Coverage Plan for Your Organization

In the ever-changing landscape of the corporate world, safeguarding your company's future is of utmost importance. With the myriad of challenges and uncertainties lurking just around the corner, it is crucial to have comprehensive protection in place. When it comes to fortifying your enterprise against potential risks and setbacks, embarking on the journey of selecting the most appropriate insurance option is an indispensable step.

Ensuring optimal security

When it comes to ensuring the long-term stability and resilience of your business, finding an insurance policy tailored to your unique needs and specifications is paramount. An insurance plan acts as a safety net, offering financial protection in the face of unforeseen circumstances or unforeseen events. Whether it is safeguarding your physical assets, protecting your employees, or covering potential liabilities, the right coverage acts as a shield against the uncertainties that can impede your company's growth.

Customized solutions for every organization

No two businesses are the same, and therefore, no insurance policy can be a one-size-fits-all solution. Understanding the intricacies and specific requirements of your industry is crucial in selecting the most suitable coverage. From property insurance to liability coverage, from employee benefit plans to cyber liability protection, the options available are diverse and adaptable. A robust insurance policy is designed to address the unique challenges faced by your business and ensures that you are adequately protected in every aspect of your operations.

Understanding the Significance of Insurance for Your Company

When it comes to ensuring the security and stability of your business, there is a fundamental aspect that should never be overlooked - insurance. This vital element plays a significant role in safeguarding your company from unforeseen risks, mitigating potential financial losses, and providing a safety net in the event of unexpected events or accidents.

Insurance serves as a protective shield for your business, shielding it from a wide array of risks and liabilities. From property damage and theft to professional errors or customer lawsuits, the right insurance coverage can provide the necessary support and financial assistance needed to keep your business operations afloat during challenging times.

Moreover, insurance not only protects your business assets but also demonstrates your commitment to responsible and ethical practices. It instills a sense of trust and reliability among your clients, employees, and partners, showcasing your dedication to safeguarding their interests and providing them with a secure environment to engage with your company.

- Ensure financial stability and security for your business

- Protect against unexpected events and accidents

- Mitigate potential losses and liabilities

- Assist in recovering from property damage or theft

- Provide support during customer lawsuits or legal claims

- Establish trust and reliability among stakeholders

- Demonstrate responsible business practices

In conclusion, understanding the importance of insurance for your business is crucial for its long-term success. By acknowledging the significance of insurance coverage, you can ensure the stability, security, and reliability of your company, reinforcing its ability to effectively navigate through potential risks and challenges. Therefore, it is essential to invest time and resources in selecting and obtaining the right insurance policies tailored to your business needs.

Evaluating the Threats and Requirements of Your Company

When it comes to safeguarding your business, it is essential to comprehensively evaluate the potential dangers and unique necessities your company may encounter. Understanding the risks associated with your industry and the specific needs of your operations is crucial for choosing an insurance policy that provides adequate protection and coverage.

An accurate assessment of the risks and needs of your business requires a systematic approach. Start by identifying the different areas where your company may be vulnerable. These vulnerabilities can include threats such as property damage, liability claims, employee injuries, or cyber attacks. Analyze the likelihood and potential impact of each risk to prioritize your insurance focus.

Next, consider the specific requirements of your business. This involves understanding the nature of your operations, the size of your workforce, the scope of your assets, and the legal and regulatory obligations you must adhere to. These factors can significantly influence the type and amount of insurance coverage your company may require.

| Risk Assessment | Necessities Evaluation |

|---|---|

| Identify potential vulnerabilities | Understand operational requirements |

| Analyze likelihood and impact of risks | Evaluate size and scope of assets |

| Prioritize insurance focus | Consider legal and regulatory obligations |

Moreover, it is crucial to consider your future growth and expansion plans as they can impact your insurance needs. As your business evolves, so will the risks you face and the coverage required to protect against those risks. Choosing a scalable insurance policy that can accommodate your changing needs can save you time and effort in the long run.

In conclusion, assessing the risks and needs of your business is a critical step in finding an insurance policy that suits your unique requirements. By thoroughly evaluating the vulnerabilities and understanding the operational necessities of your company, you can make an informed decision and ensure that your business is adequately protected against potential threats.

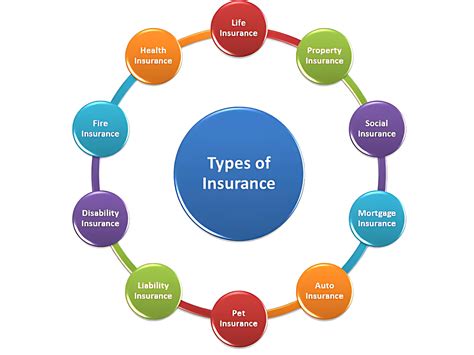

Types of Insurance Coverage Options for Businesses

When it comes to safeguarding your business against unforeseen risks, there are various insurance coverage options available. Understanding these options is vital to ensure that your business is adequately protected.

| Insurance Policy | Description |

|---|---|

| Property Insurance | This type of insurance provides coverage for physical assets, such as buildings, equipment, and inventory, against damage or loss caused by events like fire, theft, or natural disasters. |

| General Liability Insurance | General liability insurance protects your business from third-party claims of bodily injury, property damage, or personal injury. It provides coverage for legal expenses and any awarded damages. |

| Professional Liability Insurance | Professional liability insurance, also known as errors and omissions insurance, offers protection against claims of negligence, errors, or omissions arising from professional services or advice provided by your business. |

| Workers' Compensation Insurance | Workers' compensation insurance provides coverage for medical expenses, lost wages, and rehabilitation costs for employees who suffer work-related injuries or illnesses. |

| Business Interruption Insurance | Business interruption insurance helps cover lost income and ongoing expenses in the event that your business operations are disrupted due to unforeseen circumstances, such as fire, flood, or equipment breakdown. |

| Cyber Liability Insurance | Cyber liability insurance protects your business against financial losses resulting from cyber-attacks, data breaches, or other cyber-related incidents. |

These are just a few examples of the insurance coverage options available for businesses. It is crucial to assess the specific risks faced by your business and consult with an insurance professional to determine the most suitable policies to protect your unique needs and assets.

Determining the Coverage Limits for Your Business Insurance Plan

When it comes to ensuring the financial security of your company, one of the crucial aspects is determining the appropriate coverage limits for your business insurance plan. The coverage limits refer to the maximum amount an insurance policy will pay out in the event of a claim.

Setting the right coverage limits is essential to ensure that your business assets and liabilities are adequately protected. It involves carefully assessing the potential risks and liabilities associated with your industry and determining the level of protection needed to safeguard your business's future.

To determine the coverage limits, you should consider various factors such as the value of your physical assets, including buildings, equipment, and inventory. Additionally, you should assess the potential liability risks your business may face, such as personal injury claims or damage to third-party property.

- Evaluate the replacement cost of your assets: Calculate the cost to replace your physical assets in case of damage, including buildings, machinery, and technology.

- Assess your liability risks: Consider the nature of your business operations and potential risks that could lead to legal claims, such as product liability or professional malpractice.

- Review industry standards: Research the typical coverage limits that other businesses in your industry maintain to ensure you are adequately protected.

- Consider potential legal requirements: Some industries have specific legal requirements regarding insurance coverage, such as minimum liability limits.

- Factor in potential business interruption: Evaluate the potential financial losses your business may incur due to a temporary closure or interrupted operations, and consider including coverage for business interruption.

By considering these factors and consulting with an experienced insurance professional, you can determine the coverage limits that align with your business's unique needs and risk profile. Remember, adequately assessing and setting appropriate coverage limits is crucial to protect your business against unforeseen events and safeguard its long-term success.

Comparing Quotes from Different Providers

Exploring various options for insurance coverage is an essential step when seeking the most suitable policy for your enterprise. By obtaining and comparing insurance quotes from multiple providers, you can gain valuable insights into the offerings available in the market. This section delves into the importance of comparing quotes and highlights the benefits it can bring to your business.

1. Expands your knowledge: By requesting quotes from different insurers, you can gain a comprehensive understanding of the coverage options available. This allows you to explore a wide range of offerings and make informed decisions based on your business requirements.

2. Assesses cost-effectiveness: Comparing quotes enables you to evaluate the financial implications of each insurance provider's offerings. By weighing the cost against the coverage, you can determine the most cost-effective policy that aligns with your budget without compromising on essential protections.

3. Evaluates coverage details: Examining quotes from different providers allows you to compare the specifics of their coverage. You can easily identify variations, limitations, and exclusions, enabling you to select the policy that offers the most comprehensive protections for your business.

4. Considers reputation and customer service: While comparing quotes, it is advisable to assess the reputation and customer service track record of each insurer. This information can help you determine the level of support and assistance you can expect in case of any claims or issues.

5. Identifies additional benefits: By comparing quotes, you may discover additional benefits or value-added services offered by certain insurers. These benefits might include risk management resources, industry-specific expertise, or customizable coverage options that cater to your business's unique needs.

In conclusion, comparing insurance quotes from different providers plays a crucial role in choosing the most suitable insurance policy for your business. By expanding your knowledge, assessing cost-effectiveness, evaluating coverage details, considering reputation and customer service, and identifying additional benefits, you can make a well-informed decision that safeguards your business adequately.

Exploring Additional Coverage Options for Your Company

When it comes to safeguarding your organization, it's crucial to consider more than just the standard insurance coverage. Taking the time to explore additional options can provide your business with an extra layer of protection and peace of mind.

One way to enhance your insurance coverage is by considering various supplemental policies that cater to the specific needs of your industry. These specialized policies can offer tailored protection against risks that are unique to your line of work.

Another aspect to consider is the inclusion of umbrella coverage to extend the limits of your primary insurance policies. This can be particularly beneficial in situations where a major claim exceeds the limits of your existing coverage.

Furthermore, it's important to evaluate the potential risks and liabilities that your business may face. By conducting a thorough risk assessment, you can identify areas where additional coverage may be necessary, such as cyber liability insurance to protect against data breaches or errors and omissions insurance to safeguard against professional errors.

In addition to these options, exploring business interruption insurance can provide financial protection in the event of unexpected disruptions, covering expenses and lost income during a period of downtime.

Moreover, considering key man insurance can mitigate the potential impact of a significant loss by providing funds to cover the costs of hiring and training a replacement for a key employee.

Lastly, don't overlook the importance of reviewing and updating your insurance policies regularly. As your business evolves, so do the associated risks, making it essential to stay up-to-date with your coverage.

- Research and consider specialized policies for your industry

- Evaluate the benefits of umbrella coverage

- Conduct a comprehensive risk assessment

- Explore options like cyber liability and errors and omissions insurance

- Consider business interruption insurance for unexpected disruptions

- Mitigate the impact of a key employee's loss with key man insurance

- Regularly review and update your insurance policies

By considering these additional coverage options and taking proactive steps to protect your business, you can ensure that you have comprehensive insurance coverage tailored to your specific needs.

Reviewing the Terms and Conditions: An In-Depth Analysis

When it comes to selecting the most suitable insurance coverage for your enterprise, it is of utmost importance to thoroughly evaluate and understand the intricacies of the policy terms and conditions. This careful examination will enable you to make informed decisions that align with your company's specific needs and mitigate potential risks.

One fundamental aspect of this process is to pay close attention to the precise language utilized within the terms and conditions. It is essential to comprehend the meanings behind different expressions and terminologies used, ensuring clarity and accuracy in interpreting the coverage provided.

An indispensable step is to meticulously review the exclusions section. This subsection outlines scenarios or circumstances not covered by the insurance policy. Identifying these exclusions helps you gain a comprehensive understanding of the potential limitations and boundaries of the coverage, allowing you to plan and allocate resources effectively.

Another crucial aspect is examining the conditions under which claims are accepted and processed. Familiarizing yourself with the documentation requirements, time limits, and procedures for submitting claims will ensure a smoother claim process in the future. This knowledge empowers you to adhere to the necessary guidelines and avoid any discrepancies that may hinder the successful settlement of claims.

- Special attention should be given to the section regarding policy limits. Understanding the maximum coverage available per claim or aggregate limit can assist you in determining whether additional coverage is necessary.

- Furthermore, take note of any special endorsements or riders that supplement or modify the policy terms. These additions may enhance coverage in certain areas or introduce new provisions that are specific to your industry or business operations.

- Additionally, it is vital to study in detail any deductible provisions. Evaluating the amounts and conditions of deductibles will verify that they align with your risk tolerance and financial capabilities.

In conclusion, a meticulous review of the policy terms and conditions is essential for making well-informed decisions regarding your business insurance. By thoroughly understanding the language, exclusions, claim procedures, limits, endorsements, and deductibles, you can ensure that the selected policy provides comprehensive and adequate coverage tailored to your specific needs. This level of thoroughness and comprehension will ultimately contribute to the long-term stability and success of your enterprise.

Evaluating the Financial Strength and Reputation of Insurance Companies

Before making a decision on which insurance company to choose for your business, it is crucial to carefully evaluate their financial stability and reputation in the industry. By conducting a thorough analysis of their financial strength and reputation, you can ensure that you entrust your business to a reliable and trustworthy insurance provider.

Assessing the financial stability of an insurance company involves analyzing their assets, liabilities, and overall financial performance. A financially stable insurance company demonstrates the ability to fulfill their obligations and pay out claims in a timely manner. It is important to review their financial statements, such as the balance sheet and income statement, to gain insight into their profitability, solvency, and liquidity.

- Look at the insurance company's assets: Evaluate the company's investments and reserves, as well as their ability to generate consistent and substantial returns. This provides an indication of their financial strength and ability to withstand unforeseen events.

- Consider the company's liabilities: Analyze the insurance company's outstanding claims, debt, and other obligations. A substantial and well-managed reserve for future claims ensures their capability to meet the financial demands of policyholders when needed.

- Review the company's financial performance: Examine their financial statements to assess their profitability, growth, and stability over time. A profitable insurance company is more likely to be financially sound and capable of fulfilling their policyholders' claims.

In addition to evaluating the financial stability of an insurance company, it is crucial to consider their reputation in the industry. An insurance provider with a solid reputation is more likely to provide excellent customer service, prompt claims resolution, and fair policy terms and conditions.

- Check customer reviews and ratings: Look for feedback from policyholders and other businesses that have dealt with the insurance company. Their experiences can give you valuable insights into the level of satisfaction and reputation of the company.

- Research industry rankings and awards: Investigate industry rankings and awards that recognize the top-performing insurance companies. These accolades reflect the company's credibility and recognition within the industry.

- Consider the company's longevity and history: A well-established insurance company with a long history of successful operations is more likely to have built a solid reputation and gained trust from policyholders.

Evaluating the financial stability and reputation of insurance companies is a crucial step in ensuring that you choose a reliable and trustworthy provider for your business. By considering these factors, you can make an informed decision that will safeguard your business's interests in the long run.

Seeking Expert Guidance to Make an Informed Decision

When it comes to selecting the ideal insurance coverage for your company, it is crucial to seek professional advice to ensure the right choice is made. Consulting with experienced insurance professionals can offer valuable insights and assistance in navigating through the complexities of the insurance market.

Engaging with knowledgeable experts who possess in-depth knowledge of the insurance industry can help you understand the intricacies of different insurance policies and their benefits. They can provide customized recommendations tailored to your specific business requirements, ensuring you make an informed decision.

- Gain Access to Expertise: Collaborating with insurance professionals grants you access to their specialized expertise, enabling you to tap into their wealth of knowledge regarding insurance products, coverages, and industry trends.

- Thorough Assessment of Risk: Professionals in the insurance field can perform a detailed risk assessment of your business, identifying potential risks and vulnerabilities that need to be protected against.

- Cost Analysis and Comparison: Experts can assist you in analyzing the costs associated with different insurance policies, comparing them to find the most cost-effective option that meets your business requirements.

- Customized Recommendations: Working closely with insurance professionals allows for personalized recommendations that take into account your unique business needs, ensuring the chosen policy aligns with your specific goals and objectives.

- Claims Assistance: In the unfortunate event of a claim, professionals can guide you through the claims process, helping you navigate any complexities and ensuring you receive the necessary support.

By seeking professional advice, you can ensure that you make a well-informed decision, selecting an insurance policy that provides optimal protection and peace of mind for your business. Don't underestimate the value of expert guidance in securing the future of your company.

FAQ

How can I determine which insurance policy is the perfect fit for my business?

Choosing the perfect insurance policy for your business requires careful evaluation of your specific needs and risks. Start by assessing the nature of your business, the industry you operate in, and the potential risks you face. Consider factors such as property damage, liability, employee injuries, and cyber threats. It is advisable to consult with insurance experts who can guide you through the process and help you select the most suitable policy.

What are the key factors to consider when choosing a business insurance policy?

When selecting a business insurance policy, there are several crucial factors to consider. First, evaluate the specific risks that your business faces and determine the level of coverage required to mitigate those risks adequately. Next, consider the reputation and financial stability of the insurance provider. Price is also important, but it should not be the sole determining factor. Additionally, carefully review the policy terms and conditions, exclusions, deductibles, and coverage limits to ensure they align with your business needs.

Are there any specific types of insurance that every business should have?

While the insurance needs of each business vary, there are several types of coverage that are generally considered essential for most businesses. These include general liability insurance, which protects against third-party claims for bodily injury or property damage; property insurance, to cover damage to your business premises and its contents; and workers' compensation insurance, which is typically required by law and provides coverage for employee injuries. Other common coverage options may include professional liability insurance, product liability insurance, and business interruption insurance.