Delve into the enchanting realm of financial prosperity and unlock the extraordinary secrets that propel individuals towards a life of prosperity. Explore the ingenuity and strategies that can turn your ambitious yearning for opulence into a tangible reality. With a seismic shift in mindset and a relentless pursuit of financial acumen, you can traverse the path to immense riches.

Embark on a mesmerizing journey of self-discovery and empowerment, where the polished artistry of money-making maneuvers merges with the boundless potential within you. Discover the myriad of possibilities that exist to amass enviable wealth, as you unleash the full extent of your innate talents and abilities to revolutionize your financial standing.

Enter a world where strategic decision-making takes center stage, where the cultivation of resilience and perseverance lights the path towards untold affluence. Embrace the virtues of adaptability and resourcefulness as you navigate the ever-changing landscape of opportunities, armed with an unwavering vision for a life steeped in opulence.

Prepare to witness the transformation of your aspirations into a tangible reality, as you unravel the hidden dynamics of wealth creation, guided by the wisdom of industry titans who have forged their paths to fortune. Absorb their sagacity and assimilate their proven methods, as you embark on an odyssey destined to rewrite the verity of your financial journey.

Developing a Solid Plan to Achieve Financial Success

Mapping out a decisive strategy is essential for transitioning from a mere aspiration to substantial wealth. By devising a comprehensive and well-structured blueprint, individuals can steer their financial journey towards success, steadily accumulating riches and fulfilling their desires.

Create a Vision: Start by envisioning your desired financial future, outlining specific goals and aspirations. It is crucial to have a clear understanding of what achieving wealth means to you personally, whether it involves acquiring properties, starting a business, or living a life of luxury.

Establishing Milestones: Break down your grand vision into smaller, attainable milestones. These progressive stepping stones will serve as markers along your path to wealth. Each milestone should be measurable, allowing you to track your progress and make necessary adjustments to stay on course.

Identify Actionable Steps: Once your milestones are established, develop a set of actionable steps that will lead you towards each goal. These steps should be specific, realistic, and time-bound, providing a road map that guides your financial decisions and behaviors.

Embrace Financial Education: Knowledge is power when it comes to building wealth. Invest time and effort in expanding your financial literacy. Gaining insights into various investment opportunities, understanding market trends, and developing robust money management skills will empower you to make informed decisions and maximize your financial gains.

Seek Expert Advice: Don't hesitate to consult professionals in the financial field. Seeking guidance from seasoned experts who have successfully navigated their own wealth-building journeys can offer valuable insights and help you avoid common pitfalls. They can provide personalized advice tailored to your specific circumstances and goals.

Stay Committed and Persistent: Building wealth requires dedication, discipline, and unwavering determination. Stay focused on your plan, make necessary adjustments along the way, and stay committed to the long-term vision. Embrace failures as learning opportunities and continuously adapt your strategy to overcome obstacles.

Developing a clear plan to achieve wealth sets a strong foundation for turning aspirations into reality. By combining a well-defined vision, actionable steps, continuous learning, and perseverance, individuals can transform their dreams of financial abundance into a lasting and tangible success.

Setting Achievable Financial Targets

Creating attainable financial objectives is a fundamental step in transforming your aspirations of acquiring substantial wealth into a tangible reality. By establishing practical and realistic financial goals, you lay the foundation for your journey towards financial prosperity.

Setting reasonable financial targets involves identifying specific and measurable outcomes that align with your long-term vision. These objectives should be neither excessively ambitious nor overly conservative, as striking the right balance is crucial for enhancing your motivation and increasing your chances of success.

One way to set practical financial goals is to break them down into smaller, manageable milestones. By dividing your ultimate objective into more achievable targets, you can track your progress more effectively and celebrate each milestone along the way. This approach will help you stay motivated and build momentum towards greater financial success.

Furthermore, it is essential to consider your current financial situation and resources when setting realistic goals. Your income, expenses, and existing assets should be taken into account to ensure that your objectives are sustainable and attainable within your means. By embracing a holistic approach and considering both short-term and long-term financial needs, you can establish a solid framework for your financial progress.

Finally, setting realistic financial goals requires periodic evaluation and adjustment. As circumstances change and new opportunities arise, it is crucial to reevaluate your objectives and make necessary revisions. Flexibility and adaptability in your financial plan will empower you to navigate challenges and seize potential opportunities along your journey towards financial fulfillment.

Develop a Strong Work Ethic

Building a robust work ethic is essential for transforming your aspiration of attaining substantial financial resources into a tangible reality. It encompasses fostering a steadfast commitment to hard work, discipline, dedication, and perseverance. By cultivating a work ethic that is firmly rooted in determination and resilience, you pave the way for achieving long-term success and financial prosperity.

Incorporate Discipline into Your Daily Routine

Instilling discipline within your everyday life serves as the foundation for fostering a strong work ethic. Adopting a structured routine that emphasizes punctuality, organization, and focus enables you to maximize productivity and efficiency. By prioritizing essential tasks, setting achievable goals, and adhering to self-imposed deadlines, you can enhance your work ethic and ensure consistent quality output.

Cultivate a Passion for Continuous Learning

Embracing a mentality of perpetual growth and development is pivotal in developing a robust work ethic. Seek opportunities to acquire new knowledge, expand your skill set, and stay ahead of industry trends. Engage in continuous learning through reading, attending relevant workshops or seminars, and pursuing additional education. By nurturing a thirst for knowledge and innovation, you position yourself to excel in your chosen field and thrive financially.

Embrace Resilience in the Face of Challenges

Adversity is an inevitable part of any journey towards financial success. Developing a strong work ethic entails embracing resilience when confronted with obstacles and setbacks. Rather than succumbing to negativity or giving up, cultivate a mindset that sees challenges as opportunities for growth. Maintain an unwavering determination to overcome hurdles, adapt to changing circumstances, and persevere in the pursuit of your financial aspirations.

Foster a Meticulous Attention to Detail

Paying meticulous attention to detail is a key aspect of building a robust work ethic. Set high standards for the quality of your work and strive for excellence in every task you undertake. Refine your ability to identify potential errors or areas for improvement and take proactive steps to rectify them. By consistently demonstrating a commitment to precision and accuracy, you enhance your professional reputation and increase the likelihood of financial success.

Cultivate a Proactive and Solution-Oriented Mindset

A strong work ethic entails adopting a proactive and solution-oriented mindset. Rather than waiting for problems to arise, actively anticipate challenges and devise strategies to address them beforehand. Be resourceful and innovative in seeking solutions, demonstrating a willingness to take initiative and responsibility. By fostering a proactive and solution-oriented mindset, you position yourself as an invaluable asset in any professional setting, contributing to your financial growth and success.

Remember, developing a strong work ethic is not an overnight achievement, but rather a continuous journey that requires dedication, self-discipline, and a relentless pursuit of personal and professional growth. By embracing these principles and actively incorporating them into your daily life, you can turn your dream of financial prosperity into a reality.

Invest Smartly to Expand Your Fortune

In order to transform your wish of accumulating a substantial amount of wealth into a tangible reality, it is crucial to make well-informed investment decisions that foster financial growth. With careful planning, strategic choices, and judicious allocation of resources, you can significantly expand your financial portfolio and amplify your prosperity.

1. Diversify your investments: Broaden your investment portfolio by allocating your financial resources to various assets and markets. By diversifying your investments, you can minimize the risk associated with a single investment and maximize your potential returns.

2. Conduct thorough research: Knowledge is paramount when it comes to making prudent investment decisions. Before committing your funds, meticulously analyze the market trends, study the performance history of potential investment opportunities, and seek advice from experts in the field. Equipping yourself with comprehensive information will enable you to make well-grounded investment choices.

3. Embrace long-term perspective: Building substantial wealth requires patience and a long-term approach. Instead of pursuing quick gains, focus on investments that have the potential for sustainable growth over time. Aiming for steady and gradual expansion will ensure the stability and endurance of your financial fortune.

4. Allocate resources to low-risk options: While higher returns might seem enticing, it is important to balance your investment strategy by diversifying your portfolio with low-risk options. These investments provide stability and act as a safeguard against market volatility, preserving your wealth during uncertain times.

5. Stay updated with market trends: Keeping yourself informed and up-to-date with the latest market developments is crucial for making informed investment decisions. Stay attuned to economic indicators, industry news, and any shifts that may impact your investment portfolio. This knowledge will empower you to make timely adjustments and capitalize on emerging opportunities.

In conclusion, expanding your wealth requires investment choices that are based on prudence, research, and a long-term perspective. By diversifying your investments, conducting thorough research, embracing a long-term approach, allocating resources to low-risk options, and staying updated with market trends, you can navigate the path towards turning your financial dreams into reality.

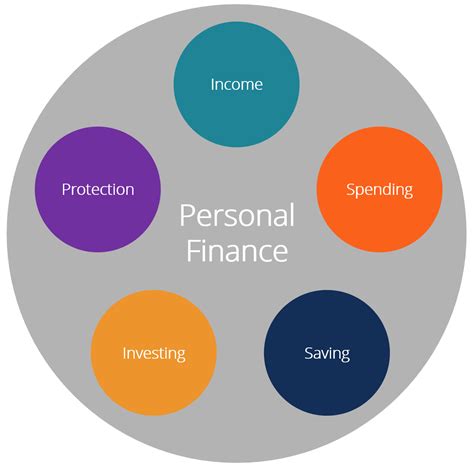

Educate Yourself About Personal Finance

Empower yourself with the knowledge and understanding to take control of your financial future. By immersing yourself in personal finance education, you can acquire the skills and insights necessary to successfully manage your money and achieve long-term financial stability.

1. Expand your financial vocabulary: Enhance your understanding of personal finance by familiarizing yourself with key terms and concepts. By becoming fluent in the language of finances, you can navigate the complex world of money with confidence and make informed decisions.

- Explore the world of banking: Learn about different types of bank accounts, how interest rates work, and the various services offered by banks. Understanding the basics will help you effectively utilize banking services and save on unnecessary fees.

- Master the art of budgeting: Develop a comprehensive budget that aligns with your financial goals. Learn how to track your expenses, allocate funds for different categories, and prioritize your spending to ensure that you can save and invest wisely.

- Get acquainted with credit: Discover the ins and outs of credit scores, credit reports, and the importance of building good credit. Learn how to responsibly use credit cards, manage debt, and leverage credit to your advantage.

2. Explore investment opportunities: Gain a deeper understanding of investment strategies and financial markets. Educate yourself about stocks, bonds, mutual funds, real estate, and other investment vehicles. By learning how to evaluate risks and potential returns, you can make informed decisions to grow your wealth over time.

- Diversify your investments: Understand the importance of diversification in minimizing risk. Learn about asset allocation and create an investment portfolio that includes a mix of different asset classes.

- Stay updated on market trends: Follow financial news and regularly review the performance of your investments. By staying informed, you can adjust your strategies as needed and potentially capitalize on emerging opportunities.

- Consider seeking professional advice: If you're unsure about certain investment decisions, consult with a financial advisor who can provide personalized guidance based on your financial goals and risk tolerance.

3. Develop good financial habits: Cultivate healthy financial habits that promote long-term financial success. Practice discipline, frugality, and delayed gratification to ensure that your spending aligns with your priorities and that you are consistently saving and investing for the future.

- Automate your savings: Set up automatic transfers from your checking account to your savings or investment accounts. This will help you build your savings effortlessly and ensure that you consistently contribute towards your financial goals.

- Pay yourself first: Prioritize saving and investing by allocating a portion of your income towards these goals before addressing other expenses. This approach will help you build wealth over time and avoid the temptation to overspend.

- Continuously educate yourself: Stay up to date with the latest personal finance trends and strategies. Read books, attend seminars, and follow reputable financial blogs or podcasts. By constantly expanding your knowledge, you can adapt to changing economic conditions and make informed financial decisions.

By educating yourself about personal finance, you can equip yourself with the tools and knowledge necessary to turn your financial dreams into reality. Take the initiative to invest in yourself and your financial future, and you'll be on the path to achieving long-term financial prosperity.

Build Multiple Streams of Income

Creating Diversified Revenue Streams

Unlocking financial abundance involves more than just dreaming about wealth. To materialize your aspirations, it is crucial to explore various avenues that can generate multiple streams of income. By diversifying your sources of revenue, you not only mitigate risks but also enhance your chances of achieving lasting financial success.

Fostering Financial Resilience

Building multiple streams of income enables you to create a safety net that safeguards you against unforeseen circumstances and economic downturns. By relying on a single income source, you put yourself at risk of financial instability. However, when you develop multiple revenue streams, you are better equipped to weather storms, effectively navigating any financial challenges that may arise.

Exploring Opportunities

Building multiple income streams allows you to tap into various opportunities for wealth creation. By spreading your resources across different ventures, you can maximize your potential earnings and increase your financial possibilities. Exploring diverse avenues and embracing new ventures not only expands your horizons but can also lead to unexpected sources of income.

Fostering Entrepreneurial Mindset

Creating multiple streams of income encourages you to adopt an entrepreneurial mindset. By actively seeking and seizing opportunities, you turn your financial dreams into a reality. Building diverse revenue streams challenges you to think outside the box, develop new skills, and venture into areas of your expertise and passion, ultimately empowering you to take control of your financial destiny.

Focusing on Long-Term Financial Security

Developing multiple streams of income is a step towards achieving long-term financial security. Rather than relying solely on one income source, diversifying your revenue streams ensures a more stable and sustainable financial future. By continually exploring new opportunities and adapting to evolving market conditions, you strengthen your financial position and increase your chances of enjoying lasting prosperity.

Surround Yourself with Successful Individuals

When striving to make your aspirations of abundant wealth a reality, one crucial factor is the company you keep. Surrounding yourself with successful people can significantly impact your chances of financial success by providing you with invaluable insights, motivation, and valuable connections.

By associating with accomplished individuals, you expose yourself to a wealth of opportunities and knowledge that can help you navigate the path to financial prosperity. Successful people often possess a wealth mindset, continuously seeking ways to grow their wealth and generate new streams of income.

- Learn from their experiences: Successful individuals have acquired a wealth of knowledge through their own journey to success. By engaging with them and exchanging ideas, you can benefit from their lessons learned, gaining valuable insights into the strategies and tactics they employed to achieve their financial goals.

- Benefit from their motivation: Surrounding yourself with successful people can be incredibly motivating. They have likely faced numerous challenges and setbacks on their path to success, yet their resilience and determination can inspire and push you to overcome your own obstacles. Their success stories can serve as a reminder that achieving financial abundance is indeed possible.

- Expand your network: Building connections with successful individuals provides a gateway to expanding your network. These individuals typically have a wide range of contacts within various industries, including investors, entrepreneurs, and influential individuals. By tapping into their network, you can enhance your own opportunities for growth and advancement.

- Achieve a growth mindset: Surrounding yourself with successful people cultivates a mindset of growth and abundance. By being exposed to their positive attitudes, perseverance, and dedication, you are likely to adopt similar traits and beliefs. This shift in mindset can be instrumental in your own journey towards achieving financial success.

- Opportunities for collaboration: Successful individuals often seek opportunities to collaborate and partner with like-minded individuals. By surrounding yourself with such individuals, you open doors to potential joint ventures and business partnerships. These collaborations can lead to shared success and mutually beneficial outcomes.

Remember, success often breeds success. Surrounding yourself with individuals who have already achieved the financial success you desire can propel you closer to your own goals. Embrace the power of association and actively seek out opportunities to connect with and learn from successful people. By aligning yourself with these individuals, you increase your chances of turning your dream of financial abundance into a tangible reality.

Stay Motivated and Persistent on Your Journey to Financial Success

In your quest for financial success, it is crucial to maintain high levels of motivation and persistence. These two qualities form the foundation for turning your aspirations of wealth into a tangible reality. By staying motivated, you ignite the fire within you that propels you towards your goals. Persistence, on the other hand, ensures that you continue to move forward despite obstacles and setbacks.

When it comes to motivation, it is vital to constantly remind yourself of the reasons why you desire financial success. Whether it be providing security for your loved ones, pursuing your passions, or gaining freedom to live life on your own terms, understanding your underlying motivations will fuel your drive. Visualize the life you aspire to live, imagining the abundance and opportunities that come with financial success.

In addition, surround yourself with positive influences and like-minded individuals who share similar goals. Engaging with supportive communities or networking with successful individuals can provide inspiration, guidance, and valuable insights. Their stories of overcoming challenges can serve as a reminder that success is achievable with hard work and determination.

Persistence is equally crucial in the journey to financial success. It involves persevering through inevitable setbacks, failures, and moments of doubt. Embrace the mindset that setbacks are merely learning opportunities and stepping stones towards your desired outcomes. Treat failures as valuable lessons that allow you to refine your approach and ultimately come closer to success.

Patience is a virtue that goes hand in hand with persistence. Building wealth takes time and effort. Recognize that overnight success is rare and focus on the incremental progress you make along the way. Celebrate small victories and milestones, as they signify your dedication and progress towards financial success.

| Key Points to Stay Motivated and Persistent: |

|---|

| 1. Understand your motivations for financial success and visualize your desired outcome. |

| 2. Surround yourself with positive influences and supportive communities. |

| 3. Embrace setbacks as learning opportunities and persist despite challenges. |

| 4. Practice patience and celebrate incremental progress towards your goals. |

FAQ

What are some practical steps I can take to turn my dream of having lots of cash into a reality?

There are several practical steps you can take to turn your dream into reality. Firstly, you need to set clear financial goals and create a detailed plan on how to achieve them. This may involve budgeting, saving, and investing wisely. Additionally, it is essential to educate yourself about personal finance, such as understanding different investment options and strategies. Building a strong work ethic and being disciplined with your finances can also contribute to your success. Remember that achieving financial wealth takes time and effort, so it's crucial to stay motivated and persistent.

How can I start saving money efficiently to reach my financial goals?

Starting to save money efficiently requires a few key steps. Firstly, you need to determine your financial goals and the specific amount you want to save. It's important to set realistic goals based on your income and expenses. After that, analyze your expenses and identify areas where you can cut back. Creating a budget can help you track your spending and allocate a portion of your income for savings. Additionally, automate your savings by setting up automatic transfers from your paycheck to a separate savings account. This will ensure that you consistently save money without the temptation to spend it.

How important is investing in turning dreams of financial wealth into reality?

Investing plays a crucial role in turning dreams of financial wealth into reality. While saving money is essential, investing allows your money to grow and work for you over time. By investing in stocks, bonds, real estate, or other assets, you have the potential to earn higher returns than what traditional savings accounts offer. However, it's important to remember that investing comes with risks, so you must educate yourself and diversify your investment portfolio. Seeking advice from a professional financial advisor can also help you make informed decisions and maximize your investment potential.

What are some tips for staying motivated on the path to financial success?

Staying motivated on the path to financial success can be challenging but achievable with a few tips. Firstly, visualize your financial goals and remind yourself of the benefits you'll enjoy once you achieve them, such as financial security or the ability to pursue your passions. It's helpful to break down your goals into smaller milestones and celebrate each achievement along the way. Surround yourself with like-minded individuals who share similar financial aspirations as this can provide support and accountability. Lastly, stay educated about personal finance by reading books, attending seminars, or following influential financial experts who can inspire and guide you.