Imagine a life where financial abundance effortlessly flows into your hands, where your earnings are not limited by time or effort. A life filled with freedom and opportunities, where you have the power to create the reality you desire. This is not a distant dream or a fantasy, but a tangible goal that can be achieved through understanding the secrets of generating wealth.

Embarking on the journey towards financial prosperity requires a shift in mindset and a willingness to embrace new strategies. It is a path that demands dedication, perseverance, and a deep understanding of the principles that govern the world of finance. Through strategic planning and informed decision-making, you can unlock the door to a life of economic independence and abundance.

In this article, we will delve into the art of earning money effortlessly, exploring powerful strategies and time-tested techniques that have enabled individuals from all walks of life to overcome financial hurdles and achieve lasting prosperity. By harnessing the power of knowledge, adopting a proactive mindset, and making informed financial choices, you can pave your own way towards financial success.

Throughout this enlightening journey, we will unveil secrets that are often obscured by the noise and chaos of the modern world. We will explore the significance of building multiple streams of income, the importance of investing wisely, and the role of mindful spending in creating financial stability. Through anecdotes and case studies, we will bring these concepts to life, presenting you with practical tools to transform your dreams of financial success into a concrete reality.

Unleashing your Financial Potential

In this section, we will explore the captivating realm of realizing your aspirations for prosperity and financial independence. Let us embark on a journey to unlock the possibilities that lie within, as we delve into strategies to empower your economic ambitions. By examining alternative avenues for generating wealth, we will equip you with the knowledge and tools required to navigate the ever-evolving landscape of financial success.

1. Diversifying Income Streams: Discover the virtuous cycle of creating multiple streams of revenue to secure your financial prospects. Learn how to leverage your skills, interests, and passions to diversify your income sources and mitigate risk in a competitive market. |

2. Cultivating a Wealth Mindset: Unearth the power of your thoughts and beliefs in shaping your financial trajectory. Explore techniques for adopting a mindset centered around abundance, resilience, and opportunism, as you embark on your journey towards achieving long-term financial prosperity. |

3. Strategic Investing: Master the art of making informed investment decisions that align with your financial goals and risk tolerance. Delve into strategies for identifying lucrative investment opportunities, understanding market fluctuations, and building a diverse investment portfolio. |

4. Leveraging Technology: Discover how advancements in technology can serve as a catalyst for financial success. Explore the myriad ways technology can be harnessed to automate processes, improve efficiency, and uncover new opportunities for generating income in the digital age. |

5. Navigating Financial Challenges: Gain valuable insights into effectively managing financial setbacks and navigating economic uncertainties. Learn how to embrace resilience, adaptability, and strategic planning, as you overcome challenges and emerge stronger on your path to financial success. |

By exploring these key areas, we aim to equip you with the necessary tools and knowledge to transform your aspirations into reality. Embarking on the pursuit of financial success requires dedication, perseverance, and an unwavering belief in your own abilities. Through careful planning and thoughtful execution, you can unlock your true financial potential and create a future filled with abundance and prosperity.

Unlocking the Secrets to Building Wealth

In this section, we will explore the hidden knowledge and strategies behind attaining financial abundance. Discover the key principles and techniques that can help you unlock a world of financial opportunities and create lasting wealth.

1. Discover Your Unique Path: Each individual has their own journey towards financial prosperity. Explore different avenues and find the path that aligns with your skills, interests, and values. Whether it's starting a business, investing in real estate, or pursuing a lucrative career, understanding your unique strengths will pave the way to success.

2. Nurture a Wealth Mindset: Cultivating a mindset of abundance and prosperity is essential for long-term financial success. Develop a positive attitude towards money, embrace opportunities for growth, and adopt a mindset that welcomes financial abundance into your life.

3. Expand Your Financial Education: Knowledge is power when it comes to building wealth. Continuously educate yourself about various financial strategies, investment opportunities, and money management techniques. Stay updated with current market trends and seek out experts in the field who can guide you towards making informed decisions.

4. Diversify Your Income Streams: Relying solely on a single source of income can limit your financial growth. Explore different avenues to generate income, whether it's through side hustles, passive income streams, or investment portfolios. Diversifying your income sources will provide stability and open up new opportunities for wealth creation.

5. Embrace Risk and Overcome Fear: Building wealth often involves taking calculated risks. Learn to embrace and manage risks effectively, as they can lead to significant financial rewards. Overcoming fear, embracing uncertainties, and adopting a growth mindset will empower you to make bold financial decisions.

6. Develop Strong Financial Habits: Cultivate healthy financial habits that support your long-term goals. Budgeting effectively, controlling expenses, saving diligently, and investing wisely are all key habits that contribute to financial stability and growth.

7. Network and Collaborate: Surround yourself with like-minded individuals who share your aspirations for financial success. Build a network of mentors, advisors, and peers who can inspire and guide you on your wealth-building journey. Collaborate with others to leverage shared knowledge and resources, opening up new opportunities for financial growth.

Unlocking the secrets to making money requires a combination of knowledge, mindset, and action. By embracing these principles and strategies, you can pave the way towards financial abundance and create a life of wealth and prosperity.

Discover Your True Passion and Monetize It

Unleashing your inner potential and finding your true calling are the key ingredients to unlocking a life of abundance and financial prosperity. In this section, we will explore the power of passion and how it can be transformed into a sustainable source of income.

Uncover Your Unique Passion

Embracing your genuine interests and desires is the first step towards discovering your true passion. Reflect on what brings you joy, excites you, and feels natural. It could be a hobby, a talent, or a deep-rooted curiosity. By identifying and acknowledging your unique passion, you lay the foundation for creating a fulfilling path towards financial success.

Cultivate Expertise and Skills

Once you have identified your passion, invest time and effort in cultivating your expertise and developing the necessary skills. Become a lifelong learner, seeking out opportunities to expand your knowledge and master your craft. As you become more skilled and knowledgeable in your chosen area, you will naturally differentiate yourself from the competition and position yourself as an authority.

Build Your Personal Brand

Establishing a strong personal brand is crucial in monetizing your passion. Communicate your unique value proposition and showcase your expertise through various channels such as a personal website, social media platforms, or networking events. Utilize compelling storytelling techniques to connect with your audience on an emotional level and build a loyal following.

Identify Profitable Opportunities

Once you have established your personal brand, it's time to identify profitable opportunities that align with your passion. Research the market, analyze trends, and identify gaps or niches where your expertise can provide value. Explore different avenues such as freelance work, consulting, creating digital products, or offering specialized services to monetize your passion effectively.

Embrace Continuous Growth and Adaptation

Finally, remember that the journey to monetizing your passion is an ongoing process. Embrace a mindset of continuous growth and adaptation as you navigate the ever-changing landscape of the business world. Stay curious, open to new opportunities, and willing to adapt your approach as needed to ensure long-term success.

By discovering your true passion, cultivating your expertise, building your personal brand, and identifying profitable opportunities, you have the potential to transform your passion into a lucrative and fulfilling career. Embrace the journey towards monetizing your passion and unlock the financial success you deserve.

Building Wealth through Wise Investments

One crucial aspect of achieving financial success without exerting excessive effort is by strategically allocating resources into wise investments. By making astute choices in where to allocate funds, individuals can slowly and steadily build wealth over time.

Investing is a pathway that allows individuals to grow their financial assets by putting their money to work for them. It involves carefully selecting and allocating funds towards various assets, such as stocks, bonds, real estate, or businesses, with the expectation of generating a return in the form of income, appreciation, or both.

Successful investment strategies often involve diversification, spreading investments across a range of asset classes to reduce risk and maximize potential returns. This strategy minimizes the reliance on a single investment and protects against significant losses in the event of an unforeseen downturn in a particular sector or market.

It is important to note that wise investments require thorough research and understanding of the chosen asset class or investment vehicle. This includes analyzing market trends, studying historical performance, evaluating risk factors, and assessing the potential for future growth.

Investors need to stay informed and updated on market conditions, economic indicators, and any factors that may impact their investments. By keeping a keen eye on the financial landscape and being adaptable to changing circumstances, investors can make informed decisions that align with their long-term financial goals.

| Key Points |

|---|

| Diversify investments across various asset classes to minimize risk. |

| Thorough research and understanding of chosen investments are crucial. |

| Stay informed and adapt to changing market conditions. |

Building wealth through wise investments is an ongoing process that requires patience, discipline, and a long-term mindset. It is essential to set realistic financial goals, establish a diversified investment portfolio, and consistently monitor and adjust strategies as necessary. With time, dedication, and wise investment choices, individuals can pave their way towards financial success and achieve their dreams of a prosperous future.

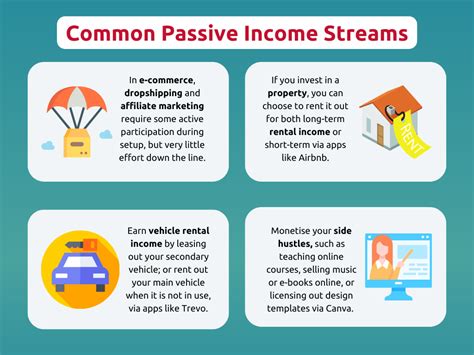

The Potential of Passive Income Streams

In our quest for financial abundance, we often envision a life free from the constraints of a traditional 9-to-5 job. While the road to achieving this may seem daunting, there is a powerful concept that can help turn our dreams into reality: passive income streams.

Passive income refers to earnings that are generated with little to no effort and involvement on our part. Unlike active income, which requires continuous work and time investment, passive income allows us to make money effortlessly while we sleep, travel, or pursue other passions. It presents a pathway towards financial independence and the freedom to live life on our own terms.

- Diversification: One of the key advantages of passive income streams is the ability to diversify our income sources. By having multiple streams of passive income, we can minimize risk and increase the likelihood of sustainable financial success.

- Versatility: Passive income can be generated through various channels, including real estate investments, stock dividends, royalties from creative works, affiliate marketing, and online businesses. This versatility allows us to explore and choose the passive income streams that best align with our interests and skills.

- Scalability: Another remarkable feature of passive income streams is the potential for scalability. With diligent planning and strategic decision-making, we can expand our passive income sources and exponentially grow our earnings over time.

- Time and Freedom: The beauty of passive income lies in its ability to grant us time and freedom. As we build and nurture our passive income streams, we gradually gain the freedom to focus on what truly matters to us–whether it be spending quality time with loved ones, pursuing hobbies, or exploring new experiences.

- Long-Term Financial Security: By establishing and maintaining passive income streams, we create a foundation for long-term financial security. Unlike traditional jobs that provide a limited income and rely on our continued efforts, passive income can continue to flow even in the absence of active work, providing stability and peace of mind for the future.

Embracing the power of passive income streams has the potential to revolutionize our lives. It allows us to break free from the conventional notion of trading time for money and instead opens doors to a more abundant and fulfilling financial future. By exploring and harnessing the various opportunities that passive income presents, we can embark on a journey towards financial independence and create a life where our money works for us, rather than the other way around.

The Power of Negotiation: Maximizing Financial Gains

In the realm of financial endeavors, there exists an invaluable skill that can propel individuals towards their ultimate monetary goals. This skill is none other than the art of negotiation. In this section, we will explore the significance of negotiation and how mastering this craft can lead to maximizing financial gains without exerting excessive effort.

- Understanding the Dynamics of Negotiation

- Preparing for Successful Negotiations

- Effective Communication Strategies

- Building Rapport and Establishing Trust

- Identifying and Utilizing Leveraging Factors

- Getting the Best Possible Deal

- Creating Win-Win Scenarios

- Overcoming Common Negotiation Challenges

- Continuous Learning and Improvement

Negotiation is an art form that requires finesse, tact, and a deep understanding of human behavior. By delving into the dynamics of negotiation, individuals can grasp the intricacies involved in securing favorable outcomes. Preparation plays a crucial role in successful negotiations, as it enables individuals to anticipate various scenarios, identify potential obstacles, and devise strategic approaches to achieve their desired financial gains.

Effective communication is paramount during negotiations. It involves active listening, articulating thoughts clearly and concisely, and gauging the responses and reactions of the other party. By mastering these communication strategies, negotiators can effectively convey their viewpoints, clarify misunderstandings, and foster a collaborative atmosphere that is conducive to mutually beneficial agreements.

Building rapport and establishing trust are essential components of successful negotiations. By developing genuine connections and demonstrating integrity, negotiators can cultivate a sense of trust and reliability, facilitating smoother discussions and increasing the likelihood of achieving their financial goals.

Identifying and utilizing leveraging factors is another critical aspect of negotiation. By identifying and leveraging their strengths, negotiators can gain advantageous positions that drive better outcomes. Whether it is knowledge, expertise, or resources, understanding and effectively utilizing these factors can significantly impact the overall success of financial negotiations.

Ultimately, the art of negotiation is about attaining the best possible deal. By employing persuasive techniques, showcasing the unique value proposition, and demonstrating the benefits for all parties involved, negotiators can create win-win scenarios that satisfy their own financial objectives while also meeting the needs and desires of the other party.

Challenges may arise during negotiations, ranging from disagreement to impasses. However, by adopting a solution-oriented mindset, actively listening, and employing creative problem-solving techniques, negotiators can overcome these challenges and steer negotiations towards favorable outcomes.

Continuous learning and improvement are fundamental in the art of negotiation. By analyzing past negotiations, identifying areas for growth, and honing their skills, individuals can refine their negotiation strategies and tactics over time. This commitment to continuous improvement ensures that negotiators are continuously evolving and increasing their effectiveness in maximizing financial gains.

Establishing a Solid Financial Framework: Budgeting and Saving

Creating a strong financial foundation is crucial for individuals striving to attain economic stability and long-term prosperity. This section focuses on the fundamental elements of budgeting and saving, which are instrumental in achieving financial security and realizing one's aspirations.

1. Developing a Budget:

- Identify your income sources and determine the amount of money you receive regularly.

- Track your expenses meticulously to gain a clear understanding of your spending patterns.

- Establish financial goals to prioritize your budget allocation effectively.

- Differentiate between essential and non-essential expenses to make informed decisions.

- Consider incorporating budgeting tools or apps to simplify the process and enhance accuracy.

2. Embracing Frugal Living:

- Adopting a mindful and intentional approach towards spending can significantly impact your financial situation.

- Identify areas where you can cut back on expenses without sacrificing your quality of life.

- Explore options for reducing recurring bills, such as negotiating insurance premiums or canceling unused subscriptions.

- Implement practical strategies like meal planning, energy conservation, and prioritizing free or low-cost entertainment.

- Develop a saving mindset by considering long-term benefits over short-term gratification.

3. Building an Emergency Fund:

- Establish an emergency fund to provide a financial safety net during unforeseen circumstances.

- Set specific savings goals and allocate a portion of your income towards this fund consistently.

- Prioritize emergency savings over non-essential purchases to ensure financial stability.

- Consider automating savings by setting up automatic transfers from your paycheck to your emergency fund.

- Regularly evaluate and adjust your savings targets as your financial situation evolves.

By implementing these budgeting and saving strategies, individuals can lay a solid foundation for achieving financial stability. Consistent effort, discipline, and a long-term perspective are key to successfully creating a strong financial framework.

Embracing Entrepreneurship: Starting Your Own Business

In this section, we will explore the concept of embracing entrepreneurship and discuss the steps involved in starting your own business. Instead of relying on traditional methods of making a living, entrepreneurship offers individuals the opportunity to create their own path towards financial independence. By becoming an entrepreneur, you can take control of your destiny and have the freedom to turn your passion into a successful venture.

One of the first steps in starting your own business is identifying a market gap or a unique idea that sets you apart from the competition. By conducting market research and understanding consumer needs, you can spot opportunities to create something innovative and valuable. This could involve developing a new product or service, or even providing an improved version of an existing offering.

Creating a Solid Business PlanOnce you have identified your business idea, it is crucial to create a solid business plan. This document outlines your goals, strategies, target market, financial projections, and other key aspects of your business. A well-crafted business plan will not only serve as a roadmap for your entrepreneurial journey but also help you secure funding from investors or financial institutions. | Building a Strong NetworkNetworking plays a crucial role in the success of any business. By building a strong network of contacts, you can gain valuable insights, learn from experienced individuals, and even find potential partners or customers. Attending industry events, joining professional organizations, and utilizing online platforms can help you expand your network and build connections that can propel your business forward. |

Securing FundingIn order to bring your business idea to life, you will likely need funding. Depending on the scale of your venture, you can explore various options, such as self-funding, seeking investors, applying for small business loans, or crowdfunding. Each option comes with its own advantages and considerations, so it is important to thoroughly research and evaluate the best financing method for your specific business. | Implementing Effective Marketing StrategiesMarketing plays a vital role in attracting customers and creating brand awareness. It involves identifying your target audience, developing a compelling brand identity, and utilizing various marketing channels to reach potential customers. From traditional advertising methods to digital marketing techniques, selecting the right strategies will help you effectively promote your business and achieve success. |

Starting your own business requires dedication, perseverance, and a willingness to take calculated risks. However, by embracing entrepreneurship and following these essential steps, you can turn your dreams of financial success into a reality. Remember, starting a business is not always easy, but with passion, determination, and a strategic approach, you can build a thriving enterprise that brings both personal and financial fulfillment.

Mastering the Mindset of Financial Prosperity

In this section, we explore the crucial role that mindset plays in attaining enduring prosperity and abundance. By understanding the intricate workings of our thoughts and beliefs surrounding money and wealth, we can uncover the key components of a mindset that paves the way for financial success.

Developing a powerful mindset involves cultivating a deep sense of self-belief and confidence, bolstered by an unwavering determination to overcome obstacles and seize opportunities. It requires embracing a mindset of abundance, where scarcity and limitations are discarded in favor of a mindset that attracts limitless possibilities.

A vital aspect of mastering the mindset of financial success lies in recognizing and challenging any self-limiting beliefs or negative thought patterns that may hinder our progress. By replacing thoughts of doubt and fear with positive affirmations and empowering beliefs, we create a fertile foundation for wealth creation and abundance.

Furthermore, it is important to embrace an attitude of continuous growth and learning. To achieve financial success effortlessly, one must constantly seek knowledge, adapt to changing circumstances, and remain open to new strategies and perspectives. This mindset of perpetual growth ensures that we are always expanding our horizons and staying ahead of the curve in the ever-evolving world of finance.

Mastering the mindset of financial success encompasses not only personal growth but also the cultivation of healthy relationships and a strong support system. Surrounding oneself with like-minded individuals who share similar aspirations can provide invaluable inspiration, motivation, and guidance on the journey towards financial prosperity.

In conclusion, the mastery of the mindset of financial success goes beyond mere financial strategies and techniques. It is a holistic approach that encompasses self-belief, abundance thinking, challenging limiting beliefs, embracing continuous growth, and building a supportive network. By cultivating this mindset, one sets the stage for effortless money-making and the fulfillment of financial dreams.

FAQ

Is it really possible to achieve financial success effortlessly?

While it may sound appealing, achieving financial success effortlessly is highly improbable. Building wealth and achieving financial success requires hard work, dedication, and smart financial decisions.

What are some effective strategies for making money effortlessly?

While there is no guaranteed way to make money effortlessly, there are some strategies that can help increase your income with less effort. One such strategy is investing in passive income streams, such as rental properties or dividend-paying stocks. Another strategy is building an online business that generates income even when you're not actively working. However, it's important to note that these strategies still require initial effort, research, and ongoing management.

Are there any risks involved in trying to make money effortlessly?

Yes, there are risks associated with trying to make money effortlessly. Investing in speculative ventures without proper research or blindly following get-rich-quick schemes can lead to financial losses. It's essential to be cautious and do thorough due diligence before venturing into any money-making opportunities. Additionally, relying solely on effortless methods can lead to complacency and hinder personal growth and development.