Within the depths of secrecy lies a captivating enigma, veiled from the prying eyes of the ordinary world. It is a clandestine realm where fortunes are hatched, concealed within the intricate layers of uncharted territories. With whispered tales of boundless prosperity and a web of intrigue that eludes comprehension, this hidden domain remains shrouded in mystery.

Embedded within the fabric of international finance, discreet transactions dance surreptitiously, evading the discerning gaze of authority. Unyielding in their efforts, individuals seek refuge in the shadows, navigating through convoluted webs of interconnected networks. With every clandestine move, they delve deeper into the labyrinthine corridors of obscured economies, where power morphs and money assumes a new form.

He whispered, they whispered and the whispers echoed amidst the hushed silence. Across borders and beyond jurisdictions, these whispers reverberate, carrying with them tales of unimaginable riches. The very essence of hidden fortunes, concealed beyond the grasp of scrutiny, tantalizes those bold enough to unravel the complex tapestry that weaves together this obscured world.

The Origins of Illicit Funds: A Global Phenomenon

The emergence and circulation of illicit financial flows have become an intricate part of the global economic landscape, spanning continents and transcending borders. This phenomenon, known by various names such as black money, dirty money, or illicit funds, refers to hidden wealth that is acquired through illegal activities or remains undisclosed for tax evasion purposes.

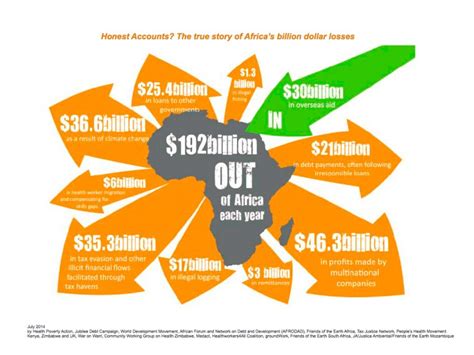

Illicit funds can originate from a multitude of sources, encompassing activities such as drug trafficking, corruption, organized crime, smuggling, tax evasion, and money laundering. These hidden assets often disrupt economies, weaken governance structures, and impede sustainable development efforts in both developed and developing nations alike.

The complex nature of the illicit financial flow phenomenon makes it difficult to accurately estimate the total amount of black money circulating globally. However, numerous studies and reports suggest that the magnitude of such illicit funds is staggering, amounting to billions or even trillions of dollars.

- Drug trafficking: The illicit drug trade remains a major contributor to the generation of black money, with criminal organizations generating enormous profits from the production, distribution, and sale of illicit drugs.

- Corruption: Corrupt practices, such as bribery, embezzlement, and abuse of power, play a significant role in the generation of illicit funds. These activities often involve individuals in positions of authority who exploit their power for personal gain.

- Organized crime: Various forms of organized crime, such as human trafficking, arms smuggling, and cybercrime, generate substantial amounts of illicit funds. These criminal networks operate globally, exploiting vulnerable populations and economies.

- Tax evasion: Concealing income and assets to evade taxes is another widespread source of black money. Individuals and corporations employ various tactics, including offshore accounts and complex financial structures, to hide their wealth and avoid tax obligations.

- Money laundering: The process of legitimizing illicit funds, known as money laundering, enables criminals to integrate their illegal wealth into the legal economy. Money laundering techniques involve disguising the origins of funds through multiple transactions and layers of financial intermediaries.

The origins of black money are deeply rooted in the underbelly of society, perpetuating a cycle of crime, corruption, and economic instability. Effectively addressing this global phenomenon requires international cooperation, robust regulatory frameworks, and strengthened enforcement mechanisms.

Unveiling the Dark Secrets: How Illicit Funds Operate

The following section aims to shed light on the intricate workings of illicit funds, delving into the obscured realm of illegal financial activities. By exploring the clandestine mechanisms utilized by perpetrators, we hope to gain a deeper understanding of the covert operations behind the illicit accumulation and transfer of wealth.

Unveiling the dark secrets of black money is an arduous task, as it involves deciphering the complexities of underground economies and clandestine networks. To comprehend how these covert activities operate, it is essential to examine various methods employed to disguise and launder illicit funds, evading detection by authorities.

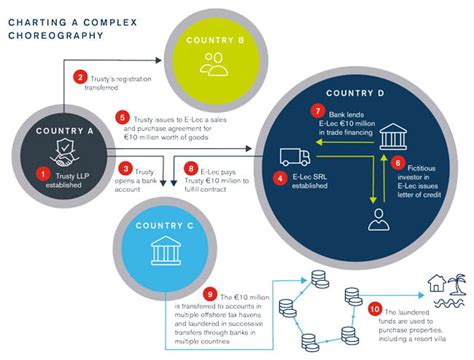

A primary strategy exploited in the realm of illicit finance is the creation of offshore entities and shell companies, which serve as conduits for money laundering. By maintaining a web of intricate subsidiaries and complex ownership structures, perpetrators can shield their identities and obscure the origins of their ill-gotten gains.

Furthermore, the utilization of cash-based transactions and the manipulation of international trade flows play crucial roles in facilitating the operation of black money networks. By engaging in bulk cash smuggling and under-invoicing of goods, illicit financiers can disguise the movement of funds across borders, enabling them to evade scrutiny and inflate their profits.

Moreover, the rise of digital currencies and their potential for anonymous transactions has further contributed to the proliferation of illicit funds. Cryptocurrencies, such as Bitcoin, offer a decentralized and untraceable means for transferring wealth, making it increasingly challenging for authorities to track and regulate illicit financial activities.

As we delve deeper into the dark secrets of black money, it becomes apparent that combating this illicit phenomenon requires a multifaceted approach. Enhanced international cooperation, stricter regulations, and robust enforcement mechanisms are essential in curbing the proliferation of illicit funds and dismantling the intricate networks that enable their operation.

| Key Points: Unveiling the Dark Secrets |

|---|

| Creation of offshore entities and shell companies |

| Cash-based transactions and international trade manipulation |

| Rise of digital currencies and anonymous transactions |

| The need for international cooperation and robust enforcement |

The Impact of Illicit Finances: Economic Ramifications

The flow of undisclosed funds and illicit financial activities can have far-reaching consequences on nations and their economies. These unaccounted funds, often hidden away from legitimate reporting channels, pose a significant threat to economic stability and development.

Illicit financial activities, including money laundering, tax evasion, and corruption, distort markets and hinder economic progress. They undermine fair competition by creating an uneven playing field, where businesses participating in illegal practices gain an unfair advantage over their law-abiding counterparts. This unfair competition can stifle innovation, discourage investment, and hinder overall economic growth.

The impact of black money extends beyond individual economies; it can have spillover effects on regional and global financial systems. The secretive nature of these funds allows them to evade taxation, reducing government revenues and potentially leading to higher tax burdens for citizens. The loss of tax revenue limits the ability of governments to invest in infrastructure, public services, and social welfare programs, exacerbating inequality and hindering socio-economic progress.

Furthermore, the existence of black money can erode trust in financial institutions and undermine the integrity of the entire financial system. This loss of trust can discourage both domestic and foreign investment, as individuals and businesses become hesitant to engage in financial transactions that may be tainted by illicit activities. In turn, this can dampen economic activity, impede capital flows, and hinder economic development.

| Consequences of Black Money: | Economic Impacts |

|---|---|

| Distortion of markets and unfair competition | Stifled innovation and hindered economic growth |

| Reduced government revenues and increased tax burden | Limitations on investment in infrastructure and public services |

| Erosion of trust in financial institutions | Discouragement of domestic and foreign investment |

The Role of Technology: Addressing Novel Challenges in Combating Illicit Funds

The rapidly evolving landscape of technology presents both opportunities and challenges in the fight against undisclosed financial resources. This section explores the significant role technology plays in the combat against illegal financial activities, shedding light on the emerging complexities that come with it.

Enhanced Financial Monitoring Technological advancements have paved the way for cutting-edge financial monitoring tools, enabling authorities to track suspect transactions, detect patterns, and identify potential illicit sources of wealth. The use of sophisticated algorithms and data analysis techniques has revolutionized the effectiveness of these monitoring systems, making it more difficult for black money operators to go unnoticed. |

Virtual Currencies: New Frontiers of Illicit Money With the rise of virtual currencies, such as cryptocurrencies, criminals have found novel ways to launder money anonymously. The decentralized and pseudo-anonymous nature of these currencies poses significant challenges for law enforcement agencies and financial institutions in tracing the origin and destination of illicit funds. This section delves into the intricate relationship between virtual currencies and black money, exploring the measures taken to mitigate their misuse. |

Artificial Intelligence: Empowering Detection and Prevention The advent of artificial intelligence has revolutionized the effectiveness of black money detection systems. Advanced machine learning algorithms can analyze vast amounts of data to identify suspicious patterns and anomalies. This subsection discusses the successful implementation of artificial intelligence in combating illicit financial activities and the ongoing challenges in staying one step ahead of ingenious money laundering techniques. |

The Dark Web: A Haven for Illicit Financial Transactions The clandestine nature of the dark web provides a breeding ground for illicit financial activities. This section explores how criminals exploit the anonymity of the dark web to facilitate money laundering, and the efforts undertaken to enhance law enforcement capabilities in tackling this emerging challenge. It also examines the collaboration between technology companies, intelligence agencies, and governments to dismantle criminal networks operating in this hidden realm. |

Global Initiatives: International Efforts Against Illicit Funds

In the ever-evolving landscape of financial crime, nations across the globe are coming together to tackle the issue of unreported funds and illegal financial activities. These international initiatives aim to combat the hidden wealth amassed through clandestine means, employing a range of strategies and collaborative partnerships.

- Strengthening International Cooperation:

- Improving Financial Transparency:

- Strengthening Anti-Money Laundering (AML) Frameworks:

- Promoting Collaboration with International Organizations:

- Enhancing Beneficial Ownership Transparency:

Recognizing the transnational nature of illicit money flows, countries are actively engaging in mutual legal assistance treaties and other arrangements to enhance cross-border cooperation. Such collaborations enable the sharing of information, intelligence, and expertise to identify and dismantle networks involved in black money operations.

International efforts are centered around enhancing financial transparency, with the implementation of measures like the Automatic Exchange of Information (AEOI) and the Common Reporting Standard (CRS). These initiatives compel financial institutions to share customer data with tax authorities, thereby preventing tax evasion and exposing undisclosed wealth.

To curtail the flow of unaccounted funds, countries are reinforcing their AML frameworks, implementing regulatory frameworks, and strengthening their supervisory bodies. This includes enacting legislation to criminalize money laundering, imposing stricter due diligence procedures, and ensuring effective enforcement mechanisms.

Collaboration with international organizations such as the Financial Action Task Force (FATF) plays a crucial role in global efforts against black money. The FATF sets international standards and monitors compliance, ensuring that countries adopt robust measures to combat money laundering and terrorist financing.

Recognizing the importance of knowing the true owners of assets and companies, jurisdictions are increasingly implementing beneficial ownership registries. These registries disclose the individuals who ultimately control or profit from certain entities, establishing greater transparency and deterring the use of shell companies for illicit purposes.

Through these collective endeavors, the international community aims to shed light on the shadowy realm of black money, disrupting illicit activities, and promoting a global financial system that thrives on integrity and accountability.

Public Perception: The Ethical Quandary of Illicit Funds

In this segment, we delve into the complex realm of public perception surrounding the morally ambiguous issue of undisclosed and illicit monetary assets. Rather than focusing on the enigmatic allure of forbidden riches, we aim to shed light on the ethical dilemmas underlying this clandestine practice.

Public perception plays a pivotal role in shaping societal attitudes towards clandestine financial transactions. The clandestine nature of these undisclosed funds has spawned a multitude of moral questions and debates. Moreover, the perception of individuals engaged in such practices varies widely, with some condemning it as an act of greed, while others perceive it as a clever means of avoiding taxation or preserving one's wealth in times of economic uncertainty.

One aspect contributing to the complexity of the moral dilemma is the inherent secrecy surrounding black money. It often hides behind legal barriers, intricate networks, and offshore accounts. While some argue that illicit financial activities harm economies and perpetuate income inequality, others argue that it is merely a consequence of an ineffective and biased taxation system, and a symptom of a broader societal issue.

Public opinion on the topic is far from unanimous. Some view individuals involved in illicit transactions as criminals, utilizing devious methods to avoid legitimate financial obligations. Others, however, perceive such individuals as astute, strategic thinkers who are maximizing their financial resources by exploiting legal loopholes. These divergent perspectives amplify the moral complexity surrounding this underground economy.

Ultimately, understanding public perception and the conflicting moral perspectives associated with black money is crucial for engaging in meaningful conversations about its consequences on modern societies. By examining the ethical quandary surrounding this issue, we can broaden our understanding of the factors contributing to the persistence of illicit funds and explore potential solutions to mitigate their impact.

Shedding Light: Strategies to Prevent and Combat Illicit Financial Activities

One of the crucial steps in addressing the issue of undisclosed and illegal financial transactions involves implementing effective strategies to prevent and combat such activities. This section aims to explore various approaches and measures that can be employed to shed light on these illicit practices and ensure the transparency and integrity of financial systems.

Enhancing regulatory frameworks and strengthening legal measures is an essential aspect of tackling illicit financial activities. By implementing stricter laws and regulations, governments can create a deterrent effect and discourage individuals and entities from engaging in black money transactions. Additionally, promoting international cooperation and information-sharing among different jurisdictions can lead to more effective identification and prevention of these activities.

Another critical strategy involves improving financial transparency through the adoption of technology and financial innovations. Utilizing advanced data analytics tools and artificial intelligence can help detect patterns and anomalies indicative of illicit financial activities. Moreover, promoting the usage of secure and traceable digital payment systems can minimize the opportunities for anonymous transactions and money laundering.

Educating the public and raising awareness about the consequences of participating in black money schemes is another vital aspect of combating illicit financial activities. By informing individuals about the societal and economic impacts of such practices, it is possible to cultivate a culture of financial integrity and discourage participation in illegal financial transactions.

Furthermore, empowering financial institutions and enhancing their capabilities to detect and report suspicious activities can significantly contribute to the prevention of black money. Training bank personnel and creating robust monitoring mechanisms can enable institutions to identify and report any potential illicit transactions promptly.

In conclusion, by adopting a multifaceted approach that involves regulatory enhancements, technological advancements, public awareness, and institutional empowerment, it is possible to shed light on the shadowy world of black money. Implementing these strategies can mitigate the risks associated with illicit financial activities and promote a more transparent and accountable financial system.

FAQ

What is black money?

Black money refers to funds earned through illegal activities or undeclared income that is not recorded for tax purposes. It typically involves money that is hidden from the government or law enforcement authorities.

How do people generate black money?

People generate black money through various means such as involvement in criminal activities like drug trafficking or corruption, tax evasion, underreporting income, or engaging in cash transactions that are not declared to the authorities.

Why is black money a problem?

Black money poses several issues in society. It undermines the economy by reducing tax revenue, increases income inequality, and hampers the government's ability to provide essential services. It also contributes to corruption, money laundering, and the financing of illegal activities such as terrorism.

How do authorities tackle the issue of black money?

Authorities employ various measures to tackle black money. These include implementing stricter financial regulations, conducting tax audits and investigations, promoting cashless transactions, creating international cooperation to combat money laundering, and encouraging individuals to declare their undeclared income through amnesty schemes.

What are the consequences for individuals involved in black money activities?

Individuals involved in black money activities can face legal repercussions such as heavy fines, penalties, or imprisonment. Their assets may be seized, and they may also bear reputational damage. Moreover, the overall impact on society from their actions can have long-lasting negative consequences.