Are you looking to enhance your financial standing and unlock new opportunities for yourself? In today's world, having a strong credit profile is more important than ever. Whether you're seeking a loan, renting an apartment, or applying for a job, your credit score plays a crucial role in determining how successful you'll be.

In this informative article, we will delve into a range of tried-and-true techniques and successful strategies that can help bolster your creditworthiness. By implementing these methods, you can optimize your financial record and pave the way for a future filled with increased borrowing power, lower interest rates on loans, and improved peace of mind.

Discover the Secrets of Credit Score Enhancement

Now, you may be wondering - how exactly can you improve your credit rating? It's a valid question, and one that we will address in detail throughout the following paragraphs. From understanding the fundamentals of credit to making smart financial decisions, we will provide you with comprehensive insights and practical tips that can make a significant difference in your life.

Take Control of Your Financial Destiny

If you are tired of feeling constrained by a poor credit score, it's time to take control of your financial destiny. Cease being a passive observer and become an active participant in your own economic success. With the right tools and knowledge at your disposal, you can initiate a positive change in your financial status, foster responsible spending habits, and ultimately achieve the credit score you've always desired.

Redefine Your Future, One Step at a Time

By following our step-by-step guide, you will learn essential strategies to revitalize your credit history and redefine your financial future. From establishing a budget to utilizing credit responsibly and resolving past mistakes, every action you take will inch you closer towards financial freedom and independence.

Tactical Measures to Enhance Your Creditworthiness

Boosting your financial reputation and enhancing your borrowing prospects involves a careful assortment of steps that can make a significant impact on your credit score. Here we present a compilation of tactical measures that can help you maximize your creditworthiness and improve your overall financial standing.

- Manage Your Payment History

- Diversify Your Credit Mix

- Maintain Low Credit Utilization

- Monitor Credit Reports Regularly

- Avoid Opening Unnecessary Credit Accounts

One of the most critical factors in determining your creditworthiness is your payment history. Ensure that you consistently make on-time payments for all your debts, including credit cards, loans, and mortgages. Avoid missing payments or making late payments, as these can have a detrimental effect on your credit score.

Having a diverse credit mix can demonstrate your ability to manage different types of credit responsibly. Strive to maintain a healthy balance between installment loans (such as car or student loans) and revolving credit (such as credit cards). However, avoid opening multiple credit accounts in a short period, as this might be seen as a risky financial behavior.

Keep your credit card balances low and avoid reaching their maximum limits. Aim to utilize no more than 30% of your available credit to showcase your responsible credit management. Regularly monitor your credit card utilization and make efforts to pay off any outstanding balances in a timely manner.

Regularly checking your credit reports can help you identify and rectify any inaccuracies, such as incorrect personal information or unauthorized accounts. Request free copies of your credit reports from the major credit bureaus and review them thoroughly to ensure the information is correct.

Although having multiple credit accounts can demonstrate your creditworthiness, it is crucial to avoid opening unnecessary credit accounts. Each time you apply for new credit, it results in a hard inquiry on your credit report, which may slightly lower your credit score. Apply for credit only when necessary and after careful consideration.

By implementing these strategic measures, you can take proactive steps towards enhancing your creditworthiness and achieving a higher credit score. Remember, improving your credit score is a gradual process that requires discipline and responsible financial management.

Regularly Monitor Your Credit Report to Stay Informed

In order to stay informed about the status of your credit, it is imperative to regularly monitor your credit report. By regularly checking your credit report, you can gain valuable insights into your financial standing and identify any potential issues or discrepancies that may affect your creditworthiness.

Monitoring your credit report allows you to keep track of your financial activities with various lenders and creditors. It enables you to verify the accuracy of information and ensure that all entries are correct. By reviewing your credit report on a regular basis, you can identify any errors, such as incorrect personal information or unauthorized accounts, and take proactive steps to rectify them.

Furthermore, monitoring your credit report regularly helps you detect any signs of fraudulent activity or identity theft. By keeping a close eye on your credit report, you can identify any unfamiliar accounts or inquiries that may indicate someone else is using your identity without your knowledge. This allows you to take immediate action to protect yourself and minimize the potential damage.

| Benefits of Regularly Monitoring Your Credit Report: |

| 1. Maintaining a clear understanding of your financial status |

| 2. Ensuring the accuracy of information on your credit report |

| 3. Identifying and correcting any errors or discrepancies |

| 4. Detecting signs of fraudulent activity or identity theft |

| 5. Taking proactive steps to protect your creditworthiness |

In conclusion, monitoring your credit report regularly is a crucial step in managing and improving your credit standing. By staying informed about your financial activities, verifying the accuracy of information, and detecting any signs of fraud or errors, you can actively work towards maintaining a healthy credit profile and achieving your financial goals.

Methods to Reduce Outstanding Credit Card Balances

Decreasing the total amount of money owed on credit cards plays a crucial role in improving one's overall creditworthiness and financial health. By implementing effective strategies and adopting responsible financial habits, individuals can effectively lower their credit card balances, leading to a more favorable credit standing in the long run.

- Make timely and larger payments: Paying credit card bills on time is essential in reducing outstanding balances. Moreover, making larger payments can accelerate the reduction process and minimize the accumulation of interest charges.

- Utilize balance transfer options: Exploring balance transfer offers from other credit cards or financial institutions with lower interest rates can be advantageous. Transferring high-interest debt to these alternative options can help individuals save money and pay off their balances more quickly.

- Develop a repayment plan: Create a structured repayment plan by prioritizing credit card debts with the highest interest rates. By allocating extra funds towards these balances, individuals can efficiently minimize their overall debt and gradually eliminate outstanding credit card amounts.

- Limit credit card usage: Reduce the temptation to accumulate more debt by limiting the usage of credit cards. Minimizing unnecessary purchases and focusing on essential expenses can prevent further increases in outstanding balances.

- Negotiate with credit card companies: Engage in direct communication with credit card companies to negotiate lower interest rates or more flexible repayment terms. This approach can make it easier to manage credit card balances and accelerate their reduction.

- Seek professional advice: Consulting with financial advisors or credit counseling services can provide valuable insights and guidance on reducing credit card balances. Professionals can offer personalized strategies and assistance in creating realistic plans to eliminate outstanding debts.

- Monitor credit reports: Regularly reviewing credit reports allows individuals to identify any errors or discrepancies that may negatively impact their credit card balances. By addressing inaccuracies promptly, they can maintain accurate records and avoid potential setbacks in reducing their outstanding debts.

By implementing these effective methods to reduce credit card balances, individuals can take significant steps towards improving their overall financial situation and enhancing their creditworthiness. Developing responsible financial habits and consistently working towards decreasing outstanding debts can ultimately lead to a stronger financial foundation and increased opportunities for future financial endeavors.

Timely Bill Payment: Building Blocks for Financial Success

In today's fast-paced world, managing our finances can be a daunting task. However, one crucial aspect that should never be overlooked is paying our bills on time. Timely bill payment serves as the foundation for building a strong financial profile and setting the stage for a brighter future.

A consistent pattern of paying bills in a timely manner demonstrates financial responsibility and reliability. It instills trust in lenders, landlords, and service providers, leading to better credit opportunities, lower interest rates, and improved financial stability.

To ensure timely bill payment, it is essential to stay organized and keep track of due dates. Creating a budget, setting reminders, and establishing automatic payments can all contribute to a stress-free and efficient bill payment process. Additionally, taking advantage of online banking and mobile applications allows for quick and convenient bill payments, eliminating the risk of missed deadlines.

Avoiding late payments is equally important for maintaining a positive credit history. Late payments can have a detrimental impact on your credit score, making it challenging to qualify for future loans or credit cards. By prioritizing timely bill payment, you can safeguard your creditworthiness and lay the groundwork for a solid financial future.

In conclusion, paying your bills on time is a fundamental component of maintaining a healthy credit profile. It showcases your reliability, builds trust with lenders, and opens doors to better financial opportunities. By adopting proactive strategies and embracing digital advancements, you can make timely bill payment a seamless part of your financial routine while safeguarding your credit score and overall financial well-being.

| Improved creditworthiness | Lower interest rates | Increased financial stability |

|---|---|---|

| Enhanced trust with lenders | Access to better credit opportunities | Reduced risk of late payment fees |

| Positive impact on credit score | Qualify for future loans or credit | Overall financial well-being |

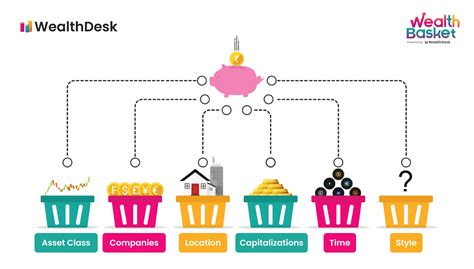

Diversify Your Credit Portfolio

When it comes to improving your financial standing, it's crucial to explore various avenues for enhancing your creditworthiness. One effective strategy is to diversify your credit portfolio. By diversifying, you can expand your borrowing options and strengthen your overall credit profile.

Consider seeking different types of credit, such as loans, credit cards, or lines of credit, from a variety of lenders. This approach helps you enhance your credit score and demonstrate your ability to manage different forms of credit responsibly. It also reflects financial versatility and reduces the risk associated with relying heavily on a single source of credit.

- Explore alternative lending options: In addition to traditional banks, research online lenders, credit unions, and peer-to-peer lending platforms. Each of these options offers unique terms and conditions that may suit your specific financial needs.

- Apply for a secured credit card: If you're looking to build credit and have trouble getting approved for a regular credit card, a secured credit card can be a good option. With a secured card, you'll need to provide a deposit, which serves as collateral and reduces risks for the lender.

- Consider a mix of installment and revolving credit: Installment loans consist of fixed amounts repaid over a specific period, such as auto loans or mortgages. Revolving credit, on the other hand, involves a credit limit that can be reused as payments are made, like credit cards. Maintaining a healthy mix of these types of credit can diversify your portfolio.

- Monitor your credit utilization ratio: Your credit utilization ratio is the percentage of available credit you're currently using. Keeping this ratio low, ideally below 30%, demonstrates responsible credit management and can positively impact your credit score.

- Regularly review and update your credit history: Ensure the accuracy of the information on your credit reports by checking them regularly. Dispute any errors or inaccuracies promptly to maintain a clean credit history.

Diversifying your credit portfolio not only improves your credit score but also increases your financial options and flexibility. By actively exploring different credit opportunities and responsible credit management, you can pave the way for a solid credit foundation and future financial success.

FAQ

How can I boost my credit score?

There are several effective tips and strategies you can follow to boost your credit score. First, make sure to pay your bills on time and in full. Late payments can have a negative impact on your credit score. Second, try to keep your credit card balances low and avoid maxing out your credit limits. Third, check your credit reports regularly for any errors or discrepancies and dispute them if necessary. Finally, avoid opening too many new credit accounts within a short period of time, as this can lower your score.

Does my payment history affect my credit score?

Yes, your payment history has a significant impact on your credit score. Payment history makes up a large portion of your credit score calculation. Making all of your payments on time and in full demonstrates responsible borrowing and positively affects your credit score. On the other hand, late payments, missed payments, and defaults can severely damage your credit score. It is crucial to prioritize timely payments to improve and maintain a good credit score.

Will paying off my debt increase my credit score?

Paying off your debt can definitely have a positive impact on your credit score. Lowering your overall debt-to-credit ratio improves your credit utilization, which is an important factor in credit score calculations. By reducing your debt, you can demonstrate responsible credit management and increase your creditworthiness in the eyes of lenders. However, it is important to note that other factors, such as payment history and credit account diversity, also play a role in determining your credit score.

Is it beneficial to close old credit accounts?

Closing old credit accounts can actually have a negative impact on your credit score. When you close an account, you reduce your overall available credit, which can increase your credit utilization ratio. Additionally, closing old accounts may shorten your credit history, which is another important factor in credit score calculations. Instead of closing old accounts, consider keeping them open and using them responsibly to maintain a longer credit history, which can positively impact your credit score.

How long does it take to improve a credit score?

The time it takes to improve a credit score can vary depending on individual circumstances. Generally, it may take several months to see noticeable improvements in your credit score. By consistently practicing good credit habits, such as making timely payments, keeping credit card balances low, and checking for errors on your credit reports, you can gradually improve your credit score over time. It is important to be patient and persistent in your efforts to boost your credit score.

What is a credit score and why is it important?

A credit score is a numerical representation of an individual's creditworthiness based on their financial history. It is important because it is often used by lenders to determine an individual's creditworthiness, and whether they are eligible for loans or other financial services.